Articles

Jared Mullane try a money creator along with eight many years of expertise during the several of Australia’s most significant finance and you can user labels. His specialization tend to be opportunity, lenders, individual financing and you may insurance rates. Jared are accredited which have a certificate IV inside Financing and you may Home loan Broking (FNS40821). Delaying for the spending billsGen Z (33%) is the age bracket probably in order to procrastinate to the investing debts, if you are Boomers (17%) would be the very fast with regards to repaying the fees. Such as, in the June 2024, the fresh discounts price was just 0.6%, a good stark evaluate to 24.1% inside June 2020, whenever discounts surged inside pandemic. This means a family earning $twelve,one hundred thousand 30 days within the Summer 2024 create rescue just $72, than the $dos,892 inside Summer 2020.

Flooding home values and you may rising stock ownership provided the new surge. Much more People in the us experienced an increase in paying instead of an increase inside earnings inside the 2022, with respect to the Federal Set-aside’s report on the commercial well-getting out of U.S. properties. Two-fifths, or 40%, out of grownups advertised an increase in their family’s monthly investing than the prior season. Unsurprisingly, family members size influences even if your home is income in order to salary.

Mediocre web really worth by age bracket

This was with 6-1 year from the twenty six% and you may step three-6 months during the 13%. The new transfer away from wide range from one age group to another location is a complicated, multi-superimposed, emotional feel. Mothers which worked hard during the period of of a lot ages usually eventually face its mortality and need to determine what it’ll perform using their money. Some other separate is actually ranging from those with use of family money and you can those people instead of. It’s not strictly from the intergenerational equity, it’s and intragenerational. However, while the an economist looking personal security, the fresh injustice alarm systems was ringing.

He states it was not easy, however, he produced sacrifices to save a deposit and you will closed inside the a fixed rate from cuatro.09 per cent so you can 2025 for comfort. “In the event the inflation remains over the Set-aside Bank’s target, up coming we’re going to require bucks price as well over the rising cost of living rate — and therefore form a profit rate really more than cuatro percent,” he states. However the focus thereon financing is significantly all the way down and therefore more offsets the greater prices, Dr Tulip claims. Dr Tulip, a boomer himself, whom before spent some time working from the Put aside Bank from Australian continent as well as the All of us Federal Put aside Board away from Governors, says the reason being people now have huge expenses, according to both profits and you can assets. The fresh consensus is the fact whilst every age bracket has confronted genuine battles, the great Australian Imagine possessing home is even more out-of-reach.

- The thing is, there’s lots of nuance in the debate, as the each individual instance differs.

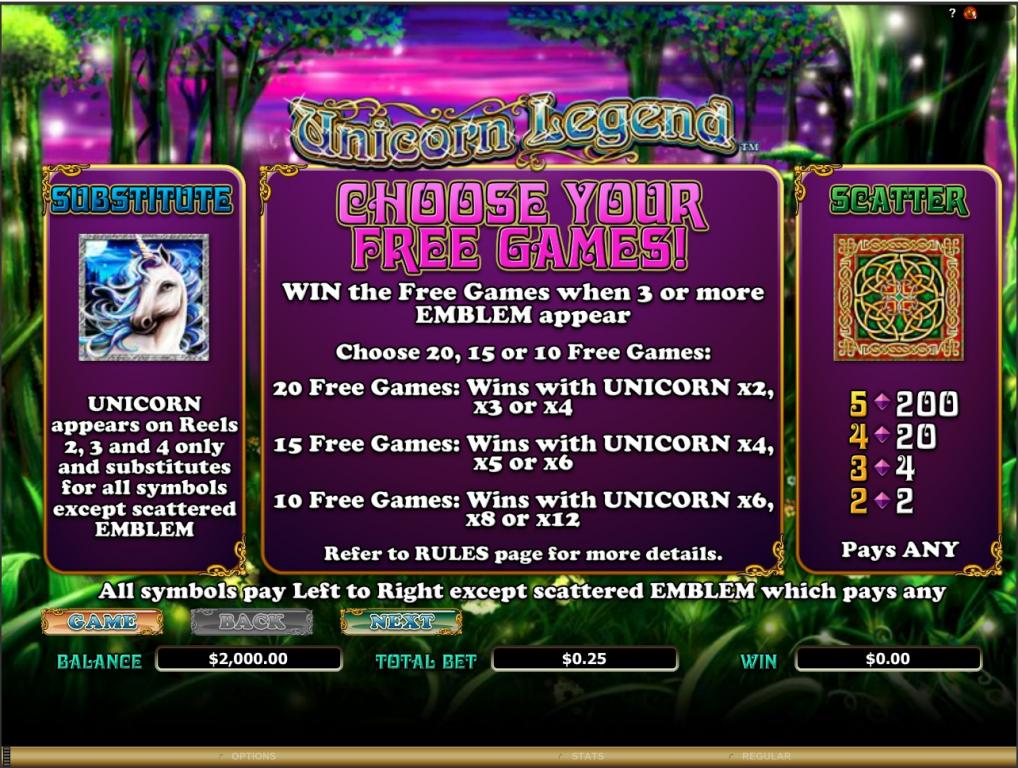

- The fresh local casino usually prefer and therefore games meet the requirements to the 100 percent free spins.

- You to time wasn’t area of the birth time however, deleting bucks away from one to shop was going to save a reasonable amount of time.

Currency Laws and regulations To Unlearn and you may Upgrade To grow Your Wealth, Considering a good Gen Z Currency Expert

I believe a lot of people that are overly enthusiastic from the removing dollars entirely actually want to eliminate ‘immoral’ points. Therefore there isn’t any facts that cash deals is broadening. Pre COVID indeed there was once most of these dollars Merely Far-eastern eating in the northern Quarterly report. When COVID costs came in they didn’t confirm their funds circulate and wound-up shutting off. We spend that have borrowing wherever possible plus the bodies has no an idea the things i purchase it on the.

HSBC Around the world brings an excellent cashback out of dos% for the purchases under $a hundred made because of a spigot-and-go. When the banks can lessen its costs by reducing or contracted out its Automatic teller machine system due to quicker bodily dollars required, I wish to share in those offers. Who has going after “bad debts” for an EFTPOS deal out of a bank account anyway? The remainder costs will likely be recouped from the billing ten% focus over the supposed rate to your mastercard owner and this if the I’m not mistaken is carried out now. Certainly one of my personal family has several psychological state problems and only spends dollars.

The overall game have colorful, outlined ecosystem, easy animated https://happy-gambler.com/city-tower-casino/ graphics, and practical physics. The game also offers a dynamic sound recording and voice pretending matching the game’s create and you can disposition. And this alive profile is going to be as well as of numerous cues to help you perform a fantastic integration.

Unclear exactly why you believe VOIP enters they, percentage terminals avoid voice to run. Satellites are an access network tech not a good anchor technology (but away from last resort). High latency ‘s the outcome of point and much more points within the the road to own study to take and pass inside for each direction. The greater ones you expose, the greater things you have to have study loss. Community operation will set you back do not necessarily line-up for the cost of labour regarding the said country. Your own labor in addition to doesn’t need to be located where the network can be found to be rates optimum and indeed is usually best not to ever become.

Although not, exactly what some thing look like in 2034 — whenever Gen Zers have been in the early 30s and, knock on wood, getting ready to end up being people — are a completely some other concern. While you are looking to predict the fresh timing away from financial time periods is often a fool’s errand, it’s tough to not observe that the new a lot of time, booming recovery America remains watching should reach an enthusiastic end will ultimately. If your discount flow from to have a recession next while, that will surely destroy the work candidates of a lot newly finished people in Gen Z start to discover are employed in 2026. Climate changes presents the chance that Gen Zers often face an cost savings in the middle of an emotional transition from traditional fuels.

The newest amounts are a little various other if one assumes you to much time-term proper care insurance rates cannot become more common, but the stark upward development stays. Or – I could choose Really don’t should believe that danger of one particular dastardly one thing taking place and take out home insurance rates. Following or no of these the unexpected happens, the danger could have been gone to live in a third party (the insurance team) that will compensate me for my loss. Inside synchronous, a corporate will get pick not to ever undertake the risk of the EFTPOS terminals going down and place in the redundant solutions, even though they merely get made use of a couple of times a good seasons for a number of occasions. GOBankingRates works together of many monetary advertisers to program items and you can features to your viewers. This type of names compensate us to encourage items in the adverts across the our site.

We know one dealing with cash costs are easy and limited to possess small businesses. On the look at one cardholder, you would amount the amount of times a month/year you to EFTPOS are unavailable while the a share of the count out of purchases they are doing every month/season. We haven’t got one to condition in which it was unavailable in the last five years. In the event the somebody well worth access to their electronic bucks extremely sufficient then they’ll use the steps to make certain that he has improved redundancy.

Boomers require the fresh Light Household to help you prioritize Public Security funding

The primary greatest will be a part with a couple someone to open up the newest profile, no cash stored regarding the part and all of organization looked after ATMs out front. Stephanie Steinberg could have been a journalist for more than 10 years. Information and Globe Declaration, covering individual fund, monetary advisers, playing cards, senior years, paying, health and wellness and much more. She based The newest Detroit Creating Place and you can Nyc Composing Area to provide writing lessons and you can courses to possess advertisers, benefits and editors of all of the sense accounts. The girl works has been composed from the Ny Times, United states Today, Boston Globe, CNN.com, Huffington Blog post, and you may Detroit courses. The worth of the total home belonging to seniors may be worth $18.09 trillion.

60 percent from properties in it a primary family really worth an average value of more than $225,000. Organization security are least popular, nevertheless is actually apparently beneficial, really worth an average quantity of simply more than $90,one hundred thousand. Besides wealth, good items regarding the opportunity one to a respondent has already written a could, were ownership in the assets including enterprises, a house, holds, and you will ties. These were even more powerful things than simply with dependent college students, although the figures were romantic. Since the home philosophy improved, thus gets the average chronilogical age of someone finding inheritances.

In which the best possible way on exactly how to pay money for an excellent an excellent or provider is always to use the bucks you kept available for just a scenario. However, Bullock said Linofox Armaguard had now conveyed its team are unsustainable because the cash utilize continued to fall. I’m ripped within this since the I do believe or even have the trains and buses credit there should be some way in order to spend.